What Are The 5 Criteria For Revenue Recognition: A Comprehensive Guide

Cpa Explains Revenue Recognition Under Gaap Rule | With Examples

Keywords searched by users: What are the 5 criteria for revenue recognition According to the five step model framework accounting requirements for revenue, Revenue recognition principle, Revenue recognition example, Criteria to recognize revenue, Revenue recognition principle là gì, Conditions to recognise revenue, Expense recognition principle, ASC 606 revenue recognition

What Are The 5 Steps In Revenue Recognition?

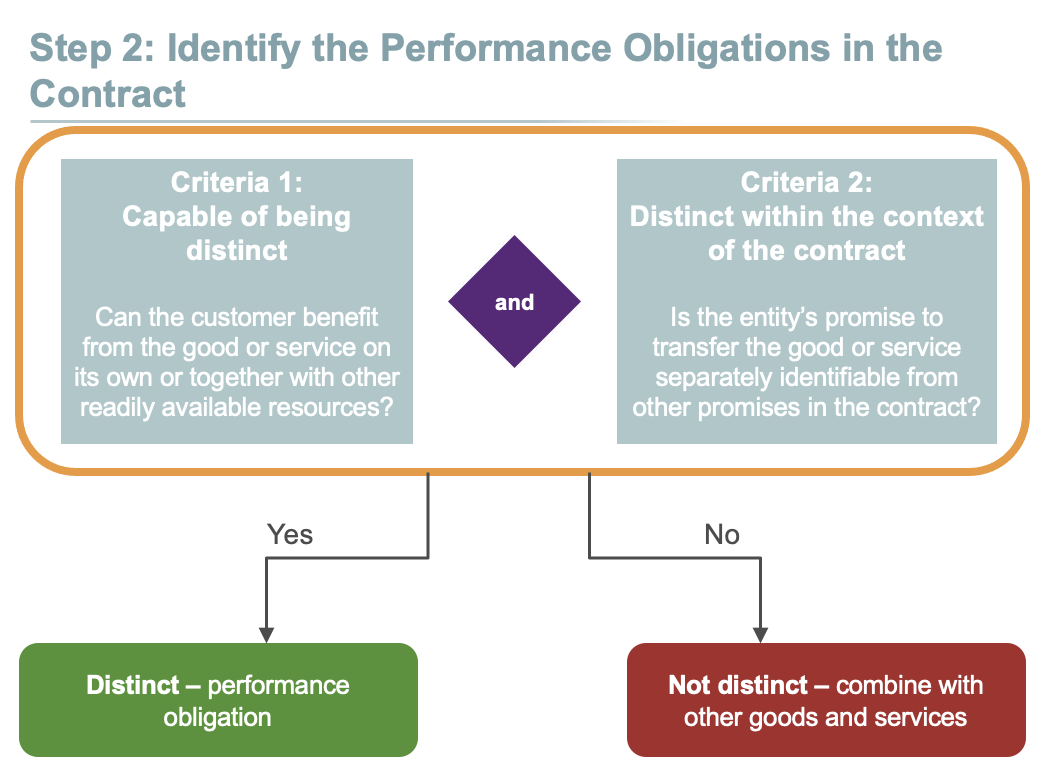

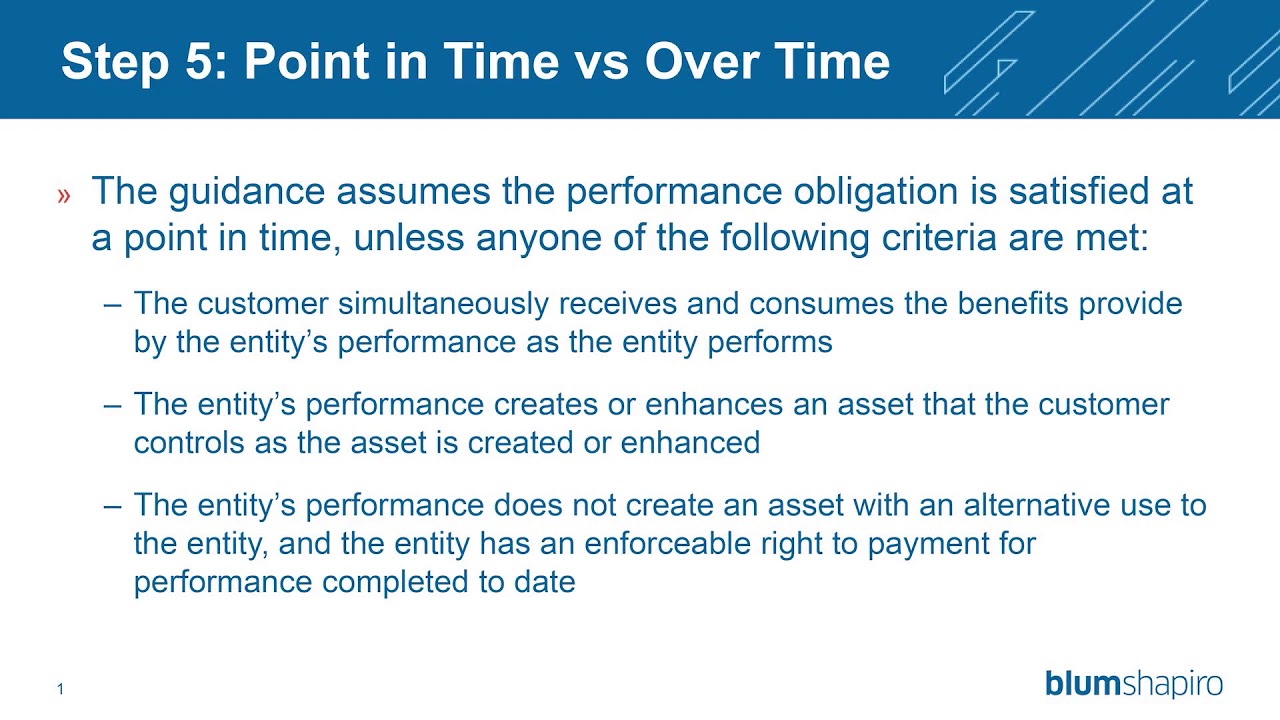

The ASC 606 how-to guide outlines a structured approach to revenue recognition, comprising five essential steps. These steps are crucial for businesses to accurately report their revenue in compliance with accounting standards. The first step is to “Identify the contract with a customer,” where companies establish the existence of a valid contract. Following this, in the second step, they “Identify the performance obligations in the contract,” clarifying the specific goods or services they promise to deliver. In step three, companies “Determine the transaction price,” which involves evaluating the total consideration expected from the contract. Afterward, in step four, they “Allocate the transaction price” among the various performance obligations. Finally, in the fifth step, businesses “Recognize revenue when the entity satisfies a performance obligation.” This step signifies the point at which revenue can be recognized, typically when goods or services are delivered as agreed upon in the contract. These five steps provide a comprehensive framework for revenue recognition and are essential for financial reporting accuracy. The information provided here is based on the ASC 606 standard as of April 26, 2023.

What Are The Basic Criteria For Revenue Recognition?

To understand the fundamental principles governing revenue recognition, it’s crucial to consider four key criteria. These criteria serve as the foundation for recognizing revenue appropriately:

-

Determinable Price: Revenue can only be recognized when the price of the goods or services can be reasonably determined. This means that there should be clarity regarding the agreed-upon value of the transaction.

-

Probability of Collection: Recognition of revenue is contingent upon the likelihood of collecting the payment for the goods or services sold. If it is probable that the payment will be received, revenue can be recognized.

-

Persuasive Evidence of Arrangement: To recognize revenue, there should be persuasive evidence that a formal arrangement or agreement exists between the seller and the customer. This agreement outlines the terms and conditions of the transaction.

-

Delivery Completion: Revenue can be recognized once the goods or services have been delivered to the customer. This signifies the transfer of control from the seller to the buyer.

These four criteria collectively guide when and how revenue should be recognized in accounting practices, ensuring transparency and accuracy in financial reporting.

What Is The Ifrs Rule For Revenue Recognition?

The IFRS (International Financial Reporting Standards) provides specific guidelines for recognizing revenue, primarily governed by IFRS 15. This standard’s fundamental principle is that revenue should be recognized when control over goods or services is transferred to the customer, and the transaction price is determined. In essence, this means that companies should recognize revenue when their customers gain the ability to use or benefit from what they’ve purchased and when the price of the transaction is established. This rule ensures that financial statements accurately reflect a company’s performance and helps stakeholders better understand its revenue generation process.

Discover 8 What are the 5 criteria for revenue recognition

Categories: Discover 100 What Are The 5 Criteria For Revenue Recognition

See more here: thichnaunuong.com

In this instance, revenue is recognized when all four of the traditional revenue recognition criteria are met: (1) the price can be determined, (2) collection is probable, (3) there is persuasive evidence of an arrangement, and (4) delivery has occurred.The core principle of IFRS 15 is that revenue is recognised when the goods or services are transferred to the customer, at the transaction price.Step 4 of the new five-step revenue recognition standard i.e. ASC 606, requires the allocation of the transaction price to each performance obligation in a contract with a customer. The transaction price is the basis for measuring revenue. It is not always the price set in the contract.

- Identify the contract.

- Identify separate performance obligations.

- Determine the transaction price.

- Allocate transaction price to performance obligations.

- Recognise revenue when each performance obligation is satisfied.

- Identify the contract with a customer.

- Identify the performance obligations in the contract.

- Determine the transaction price.

- Allocate the transaction price.

- Recognize revenue when the entity satisfies a performance obligation.

Learn more about the topic What are the 5 criteria for revenue recognition.

- IFRS 15 – revenue recognition steps | ACCA Global

- ASC 606 how-to guide: Revenue recognition in five steps – Stripe

- Revenue Recognition Criteria – Importance and Significant …

- IFRS 15: Revenue from Contract with Customers – PwC

- Step 4 – Allocation of Transaction Price – RevGurus

- IFRS 15 – revenue recognition steps | ACCA Global

See more: blog https://thichnaunuong.com/architecture