How Does An Increase In Interest Rates Affect Consumers Finances?

How Does Raising Interest Rates Control Inflation?

Keywords searched by users: How does an increase in interest rates affect consumers Why Fed increase interest rate, Fed increase interest rate effect on stock market, How interest rate affect inflation, In an effort to the rate of inflation many banks have raised their interest rates, How does an increase or decrease in interest rates affect homeowners savers companies and banks, Interest rate effect, Fed raises interest rates, How fed interest rates affect cryptocurrency

Why Are High Interest Rates Bad For Consumers?

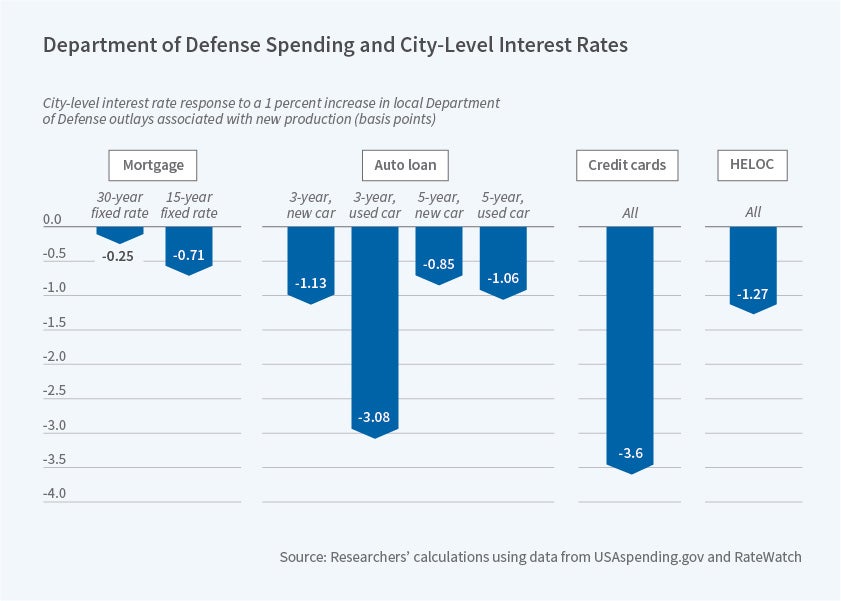

Why do high interest rates have a negative impact on consumers? Higher interest rates can often have a detrimental effect on the overall economy because they lead to increased borrowing costs for both individuals and businesses. This means that when interest rates are high, consumers and businesses have to pay more in interest when they take out loans or use credit. As a result, it becomes more expensive for them to finance purchases, invest in new projects, or expand their operations. This increase in borrowing costs can lead to reduced spending and investment, which, in turn, can slow down economic growth. As of March 3, 2023, this issue remains a concern for the economy.

How Does Raising Interest Rates Lower Consumer Prices?

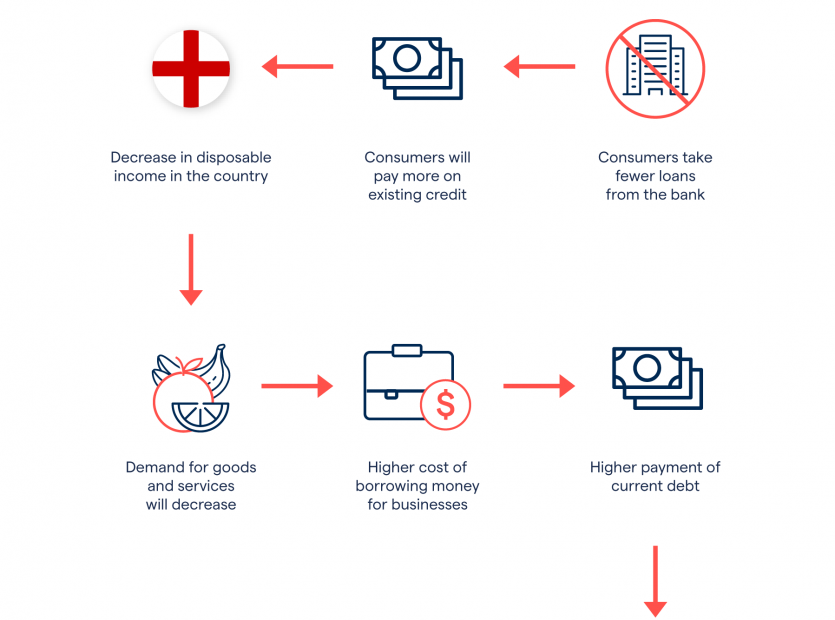

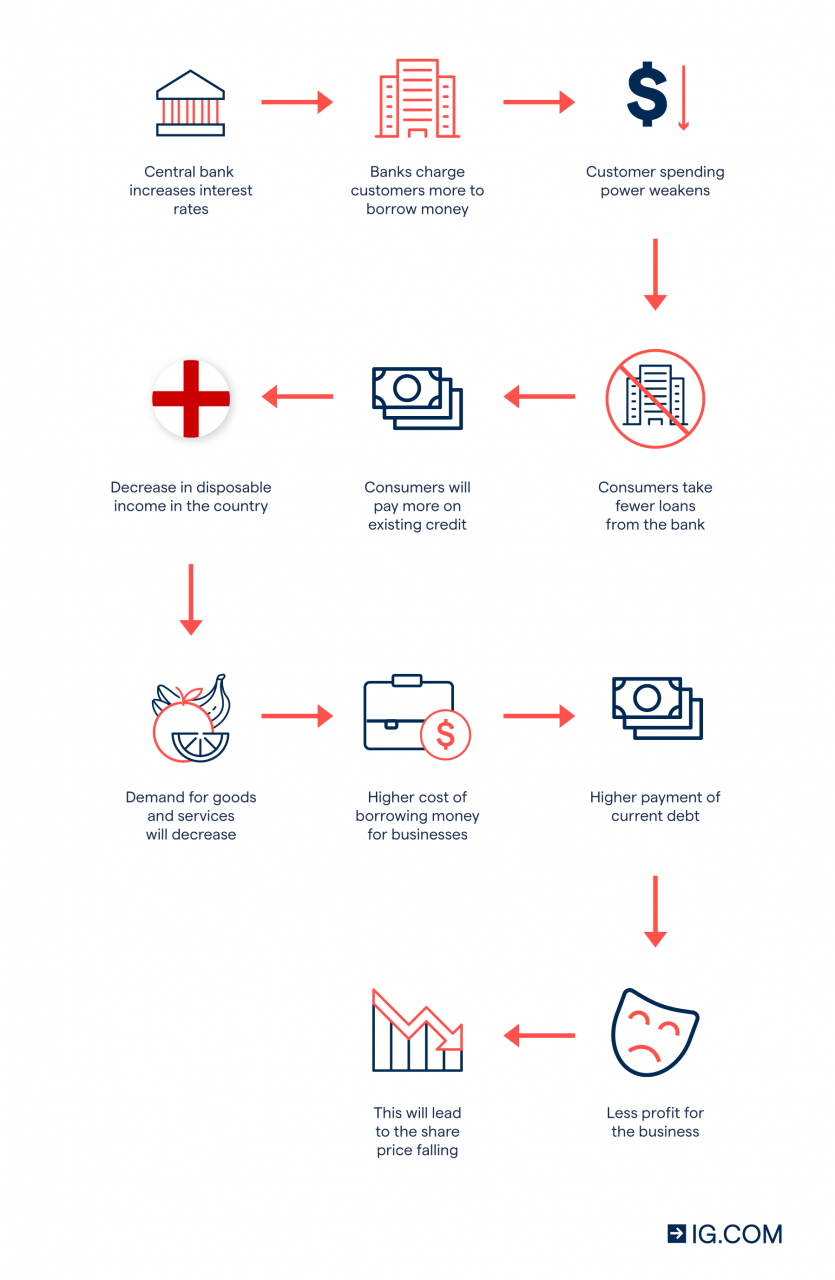

How does the process of raising interest rates lead to a decrease in consumer prices? The concept behind this phenomenon is that when the cost of borrowing money or maintaining a credit card balance becomes more expensive, consumers are inclined to reduce their spending. This reduction in consumer spending, in turn, leads to a decrease in overall demand for goods and services. Over time, as demand falls, the prices of everyday goods and services tend to decline as well. This economic mechanism is often employed by central banks as a tool to manage inflation and stabilize the economy. Please note that the date mentioned, July 12, 2023, is not relevant to the explanation and can be omitted.

How Might High Interest Rates Discourage Consumers?

How do high interest rates affect consumers and the broader economy? When interest rates are elevated, individuals looking to purchase items that necessitate taking out loans, such as homes or automobiles, find themselves facing increased borrowing costs due to the elevated interest rates associated with these loans. This added financial burden discourages consumer spending, as it becomes more expensive to finance these major purchases. Consequently, this reduction in consumer spending can have a ripple effect on the overall economy, potentially causing it to decelerate or even stagnate.

Collect 30 How does an increase in interest rates affect consumers

:max_bytes(150000):strip_icc()/how-inflation-affects-your-cost-living.asp_V2-b11e1ddb3ca24bb18e2a66c23b9ee0a6.png)

:max_bytes(150000):strip_icc()/factors-affect-mortgage-rates_final-e70ed5b382434255928bf3246b6f4b8f.png)

:max_bytes(150000):strip_icc()/how-do-interest-rate-changes-affect-profitability-banking-sector.asp-final-154a70844d174fbb95bd09f5832d4b90.png)

Categories: Top 25 How Does An Increase In Interest Rates Affect Consumers

See more here: thichnaunuong.com

In general, higher interest rates discourage consumption and encourage saving. Lower interest rates encourage consumption and discourage saving because there is less point in saving money. When interest rates decrease, it becomes cheaper for individuals to borrow money, which can encourage them to consume more.Higher interest rates typically slow down the economy since it costs more for consumers and businesses to borrow money.As the theory goes, if it’s more expensive to borrow money or carry a balance on a credit card, consumers will spend less. When spending declines, demand will fall and, eventually, so will the price of everyday goods.

Learn more about the topic How does an increase in interest rates affect consumers.

- The Effect of Interest Rate Changes on Consumption – MDPI

- Pros and Cons of Rising Interest Rates | Fifth Third Bank

- How raising interest rates helps fight inflation and high prices – NBC News

- Impact of Fed Interest Rate Cuts on Consumers – Investopedia

- These Sectors Benefit From Rising Interest Rates – Investopedia

- The Inflation and Interest Rates Relationship – Arizona Bank & Trust

See more: blog https://thichnaunuong.com/architecture